What types of businesses qualify for Section 179?

- Only “For Profit” companies can take advantage of Section 179

- SLG & Non-Profit entities DO NOT QUALIFY – because they don’t pay income tax

Per the IRS Tax Code

- Section 179 of the United States Internal Revenue Code, allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated

In plain English…..

- The Section 179 Deduction is a provision to encourage businesses to purchase the required equipment and help them stay competitive by writing off the full amount of the equipment / software on their taxes for the current year.

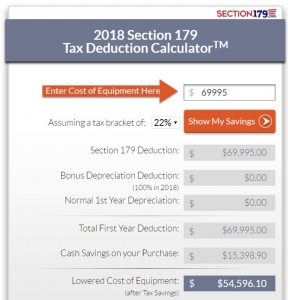

Section 179 Example (The client saved over $15K off their tax liability)

Here is an example of Section 179 being applied to a Oce’ Colorado sale.

- If the client pays cash – they get their new Colorado – but they also deplete their cash resources by $70K

- By leasing the Colorado, they keep their cash & get the write-off!

What does this mean for clients?

Businesses can immediately expense more under the new law - A taxpayer may elect to expense the cost of any section 179 property and deduct it in the year the property is placed in service. The new law increased the maximum deduction from $500,000 to $1 million.

What equipment & software qualifies for Section 179?

- ALL HARDWARE

- ALL SOFTWARE (SERVICES, DESIGN & IMPLEMENTATION INCLUDED)

PLEASE REMEMBER

- In order for leased equipment to qualify for section 179 – there must be a stated purchase option on the lease document of 10% or $1.00.

- Please check with your CPA and / or Accountant.