Section 179 Increased to $1,000,000 for 2019

Why Use Section 179?

Successful businesses take advantage of legal tax incentives to help lower their operating costs. The Section 179 Deduction is a tax incentive that is easy to use and gives businesses an incentive to invest in themselves by adding capital equipment - equipment that they use to improve their operations and further increase revenue.

In short, taking advantage of Section 179 Deduction will help your business add equipment, vehicles, and software, while allowing you to keep more of your tax dollars.

Section 179 has been increased to $1,000,000 for 2019, as stated in H.R.1, aka, The Tax Cuts and Jobs Act. The deduction limit for Section 179 is $1,000,000 for 2019 and beyond, while the limit on equipment purchases remains at $2.5 Million.

Further, the bonus depreciation is 100% and has been made retroactive to 9/27/2017. It is good through 2022. The bonus depreciation also now includes used equipment.

Free Tools That Make Calculating Section 179 Deductions Simple:

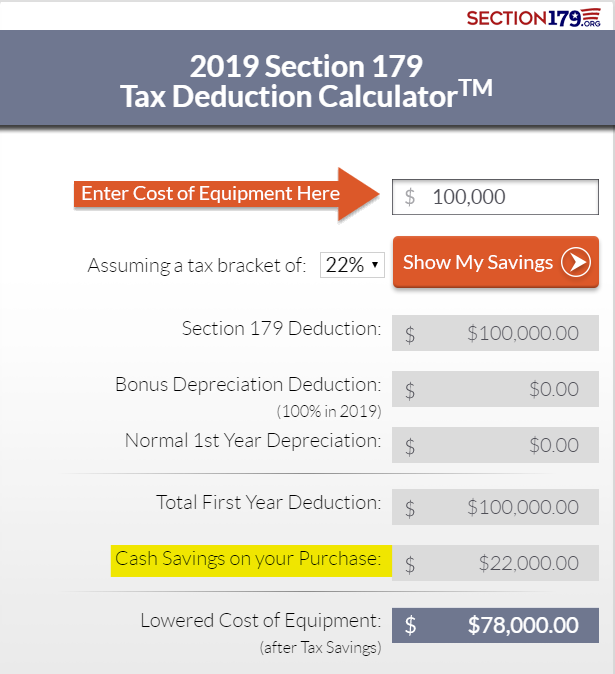

Section 179 is simple. You buy, finance or lease qualifying equipment, vehicles, and/or software and then take a FULL tax deduction on for THIS year. To give you and estimate of how much money you can save, below is an example on a $100,000 equipment acquisition using our Section 179 Deduction Calculator to make computing Section 179 deductions simple.

If you use the calculator, take special note of the total savings on your tax obligation. Many people find that, if they lease or finance their Section 179 qualified equipment, the tax savings will exceed the total of the first year's payments on the equipment. This makes buying equipment profitable for the current tax year. This is perfectly legal, and a good example of the intended incentive that Section 179 has provided to small and medium businesses.

Frequently Asked Questions:

How much can I save on my taxes this year?

It depends on how much qualifying equipment and software you purchase and put into use this year. Contact your RMC Sales Representative, we have a fully updated Section 179 Calculator that can show you your expected tax savings.

What sort of equipment qualifies for Section 179?

Most tangible business equipment, both new and used, qualifies. Additionally, "Off-The Shelf" Software also qualifies for Section 179 Tax Savings.

When do I have to do this by?

Section 179 always expires at Midnight, December 31st. To take advantage of Section 179 this year, you must buy (or lease/finance) your equipment, and put it into use, by December 31st 2019.

Contact Your RMC Sales Representative Today to Take Advantage of These Tax Deductions!